I recently participated in the European Lotteries’ EL Instant Games Webinar. As Senior Director International Sales, Instants Services, I represented IGT on the Suppliers Panel, covering myriad topics related to instant games’ past growth and future potential.

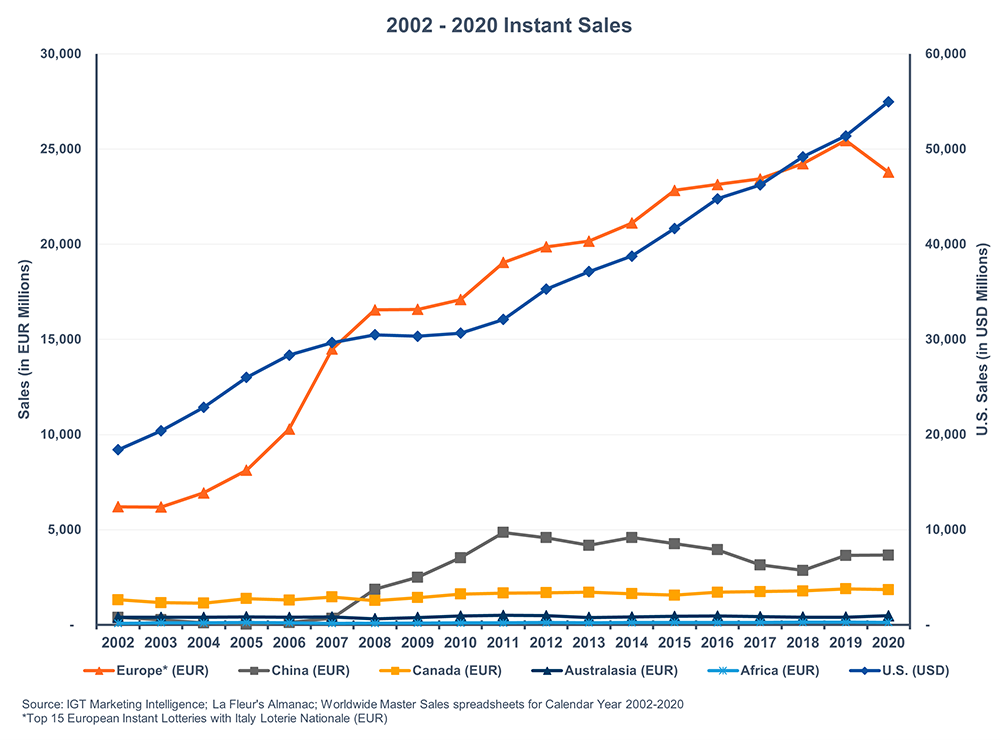

There is no denying that digital instant games are on the rise. Research firm H2 Gambling Capital estimates that there was a 37% YOY increase in iLottery in Europe in CY2020, with even greater amounts in individual countries, such as Italy (56%) and Belgium (48%). As a result, one question continues to emerge regarding instant games: “is the paper instant ticket dead?” In short—no; there is still lots of potential for paper instants, demonstrated by the tremendous category growth in recent years:

Let’s consider the U.S. market. Since 2010, we have said that the U.S. market has attained a maturity and will be difficult to surpass, but as an industry we have, years after year, created 6% annual growth. The decades-long upward instants growth trend in the U.S. is the result of continually augmenting our understanding of the diverse needs and motivators of players and, in turn, moving to diversify our product offerings accordingly. In Europe, many markets are far from their maturity and this is where the real significant growth lies in the next 10 years. May the growth be from less restrictions or optimization of portfolio, prize structure, distribution or network, the opportunity is clearly there. While the pandemic has certainly had a negative effect on other facets of the lottery and gaming industry for various reasons, in Europe, sales have risen in the instants category, with some markets seeing increases of 20-40% and more. The same has been felt also in the rest of the world. Not only are instants surviving, but they are thriving.

Nevertheless, questions persist. Are we going to end up like the music industry, where streaming now represents over 80% of the market [1]? Or will we go the way of the book industry, where paper books still represent 70% of the industry in some markets [2]? Like with books, when it comes to physical instant tickets, the tactile nature of the product cannot be understated. In reality, instants and eInstants in Europe co-exist harmoniously, as they answer different needs of the player base.

That said, eInstant games do benefit from the features and progress made by paper instant games. Among lotteries already in a digital space, the unanimous feedback is that it improves the relevance of the lottery brand and also increases purchase propensity when the consumer is in a retail environment. Many of the successful eInstant games IGT provides are built based on top-performing paper instant games to encourage new player acquisition by providing familiar themes and icons. Popular IGT slot titles are leveraged across both the instant and eInstant categories with notable performance.

The reverse is now possible as well, and we are currently adapting a draw-based game to create an eInstant game for a North American lottery and are printing our first retail instant game derived from an eInstant. We have typically used retail brands to generate eInstant tickets to capitalize on the synergies of strong retail brands. Later this year, we will be launching an instant game with one of our North American lotteries that takes a successful eInstant game and leverages those assets to create a print ticket to accompany the launch. As the eInstant market matures and successful brands are created within those channels, we can take strong digital games and convert those to retail instant games to reverse the omni-channel flow while still benefiting from familiar brands across multiple channels

Paper instant games also coexist very well with digital- and internet-based second-chance programming. Strategies such as these allow operators to capitalize on branding and marketing synergies and consistently deliver results.

The instants market in Europe is poised for continued explosive growth, and we need to evolve along with it to ensure we continue to offer the best value proposition to players. IGT is continually looking for new ways to provide our instants customers the tools with which to grow while adapting to a rapidly changing market, including insights into growth drivers such as optimal portfolio mix, price points, and innovative products. Learn more about these strategies in our next post.

[1] Source: British Phonographic Industry, All About the Music 2021: bpi.co.uk/news-analysis/bpi-publishes-its-yearbook-all-about-the-music-2021/; and Statista, 5 March 2021: statista.com/chart/8836/streaming-proportion-of-us-music

[2] Source: American Association of Publishers, December 2019 Percentage Share by Format: https://publishers.org/news/aap-december-2019-statshot-report-publishing-industry-up-1-8-for-cy2019/